Foreword: The “Joint” of Global Industry

In modern industrial systems, bearings serve as the “joints of machinery,” core components that ensure the stable and efficient operation of equipment. Their performance directly determines mechanical friction loss, energy efficiency, and productivity. For a long time, China, as a major global producer and consumer of bearings, has been undergoing a profound structural transformation. The core of this transformation is a comprehensive shift from a focus on production scale to an emphasis on improving technical standards, strengthening quality control, and building a globalized service system.

This report aims to provide an in-depth analysis of the current state and future trends of China’s bearing industry, offering global partners a comprehensive industry perspective. By meticulously reviewing macroeconomic data, technological advancement paths, quality management systems, and supply chain advantages, this report will illustrate how China’s bearing manufacturing sector is moving from traditional production models toward “Intelligent Manufacturing in China.”

Additionally, we will use a prominent industry representative as a case study to demonstrate how Chinese manufacturers are combining reliable performance with excellent cost-effectiveness to provide competitive, high-quality solutions for global clients. According to data from the China Bearing Industry Association, the Chinese bearing industry achieved a record revenue of 231.5 billion yuan in 2024, a year-on-year increase of 6.2%, with production reaching 33.7 billion sets, a 17.3% increase. These figures provide a solid macroeconomic foundation for this report.

Overview of China’s Bearing Industry: A Structural Transformation from Quantity to Quality

In-depth Analysis of Market Size and Production-Sales Data

The Chinese bearing industry has shown strong growth momentum in recent years. It continues to lead not only in production volume but also in expanding its market size. In 2024, the bearing industry set a new revenue record, reaching 231.5 billion yuan, with production increasing to 33.7 billion sets, reflecting that the industry is entering a flourishing stage. The outlook for the future market is also optimistic, with forecasts suggesting that by 2025, the market size of China’s bearing industry is expected to reach 334.5 billion yuan. These figures are not just mere numerical growth; they collectively outline China’s strategic plan to accelerate its industrialization process as the world’s largest bearing consumption market.

On the global market map, the Asia-Pacific region, with its rapid industrial development, has become the world’s largest bearing consumption market, accounting for 50% of global consumption, followed by Europe and North America. Against this backdrop, China, as a core manufacturing hub in Asia, is increasingly influential. In the first quarter of 2024, China’s bearing exports maintained a solid growth of 8.7%, with a year-on-year increase of 25.3% in March alone. This indicates that Chinese-made bearings are gaining wider recognition and demand globally, especially in high-standard markets like Europe and America. This growth is not merely dependent on traditional low-cost advantages but is built on the value creation of a more efficient and resilient supply chain.

To more intuitively present the macroeconomic development of China’s bearing industry, the following table summarizes key economic indicators, providing a comprehensive view of the overall health of the industry from production to export.

| Indicator | 2024 Data | 2025 Forecast | Notes |

| Total Industry Revenue | 231.5 billion yuan | 334.5 billion yuan | A new historical high, showing continuous market expansion |

| Total Bearing Production | 33.7 billion sets | – | A 17.3% year-on-year increase, showing strong production capacity |

| Export Volume (Q1) | 205,182 tons | – | An 8.7% year-on-year increase, reflecting solid international market demand |

| Industrial Added Value (First Half) | – | 9.37% year-on-year increase | Shows the industry’s increasing contribution to the overall industrial economy |

Industrial Structure and Key Downstream Markets

The strong competitiveness of China’s bearing industry stems from its complete and highly efficient supply chain. This chain can be clearly divided into three main segments: the upstream raw material suppliers, the midstream bearing manufacturers, and the broad downstream application fields.

Upstream, the primary raw materials for bearings are steel (especially bearing steel) and non-metallic materials. It is noteworthy that the concentration of China’s bearing steel market is relatively high, with the top four bearing steel manufacturers accounting for a combined 71% of the market. This provides a stable and guaranteed raw material supply base for midstream manufacturers. This highly concentrated upstream structure effectively reduces supply chain risks, providing strong support for the large-scale production and cost control of bearing products.

The midstream group of bearing manufacturers is large, but the overall market concentration is relatively low. As of 2019, the market’s CR10 in China was only 28.6%. This structural characteristic has led to widespread product homogeneity and fierce market competition, with most enterprises primarily producing low-to-mid-range bearing products with relatively low technical barriers and precision requirements. However, this is not the full picture of the industry. Driven by national strategies, a few Chinese enterprises have been able to manufacture high-end bearings for extreme conditions in specific fields such as national defense, aerospace, and high-speed rail, for example, bearings used in the Type 99A tank and heavy-lift helicopters. This “dual structure” indicates that while competition in the low-to-mid-range market is intense, breakthroughs in high-end technology have provided a clear direction and a technological lead for the entire industry’s upgrading.

Downstream application markets are the direct drivers of bearing industry development. The automotive industry is the most extensive application field for bearings, accounting for as much as 45% of the total in 2022. In addition, emerging and heavy industry sectors such as wind power and engineering machinery have also generated huge demand for bearing products.

It is worth noting that structural changes in downstream markets are having a profound impact on the bearing industry. For example, with the popularization of new energy vehicles (NEVs), their power structure has fundamentally changed from that of traditional internal combustion engine vehicles, leading to a 50% to 60% reduction in the number of bearings used per vehicle. This trend poses a severe challenge for manufacturers focused on traditional automotive bearings but also brings huge new opportunities for companies that can develop innovative products for new energy applications, such as insulated bearings.

Industrial Clusters and Regional Advantages

Another notable feature of China’s bearing manufacturing sector is its highly concentrated, cluster-based development. Multiple manufacturing hubs have been formed across the country, centered in specific regions such as Wafangdian in Liaoning, Luoyang in Henan, Suzhou-Wuxi-Changzhou in Jiangsu, Eastern Zhejiang, and Liaocheng in Shandong. These regions, through specialized division of labor and collaborative development, have formed an efficient production network that has significantly enhanced the overall industry’s production efficiency and supply chain resilience.

Taking Liaocheng, Shandong as an example, this region is not only one of China’s major bearing production bases but also its largest bearing trading market. The local bearing industry’s annual revenue exceeds 50 billion yuan, accounting for one-tenth of the national market share. To further enhance its global competitiveness, Liaocheng has leveraged the national “Belt and Road” initiative, collaborating with departments such as the Shandong Port Group to establish the Liaoxi International Dry Port and launch direct full-bill-of-lading trains to global ports. This strong logistics infrastructure and efficient supply chain network enable Chinese-made bearings to be transported to all parts of the world with greater speed and efficiency, especially to major export markets in Europe and America. This value creation across the entire chain, which goes beyond simple labor cost advantages, has become the core and growing competitiveness of Chinese bearings in the global market.

From “Made in China” to “Intelligent Manufacturing in China”: A Leap in Technology and Quality

Technology Innovation Driven by National Strategy

The transformation and upgrading of China’s bearing industry are not accidental; they are deeply rooted in national-level strategic planning. As early as 2015, bearings were listed as one of the “Five Major Industrial Engineering Projects,” marking the industry’s official entry into the fast lane of technological and product upgrading and transformation. In the subsequent “Thirteenth Five-Year Plan,” the machinery industry focused on the R&D of high-end bearing products, prompting some enterprises with capital and technological advantages to invest heavily, thus initiating a period of innovation for the industry.

Nevertheless, the industry still faces challenges on its path toward high-end development. For example, in key manufacturing processes such as heat treatment and grinding, there is a widespread issue of low precision and low application rates of advanced technology, which to some extent restricts the development of high-end bearings in China. However, it is precisely these challenges that have created the urgency for technological breakthroughs. Some forward-looking Chinese manufacturers have already made significant progress in specific areas, especially in the R&D of high-performance, high-value-added products. These technological achievements have not only filled domestic gaps but have also broken the long-standing technological monopoly held by international giants in certain fields.

Stringent Quality Management and Standardization System

To ensure that product quality aligns with international standards, Chinese bearing enterprises have generally established a rigorous quality management and standardization system. The core of this system is adherence to and implementation of multiple international and national certification standards. For instance, leading industry enterprises have taken the lead in passing international quality management system certifications such as ISO9000, VDA6.1, ISO14001, QS9000, and IATF 16949. These certifications are not just passports to the international market; they are direct proof that a company’s product quality and management level are synchronized with global standards.

In specific quality control processes, Chinese enterprises strictly adhere to a series of national standards (GB/T) and industry standards (JB/T). For example, in the production of automotive wheel hub bearing units, manufacturers must meet standards such as JB/T 10238-2017 and JB/T 13353-2017. These standards have detailed and rigorous specifications for key performance indicators, including:

- Grease Leakage Rate: After a high-speed durability test, the temperature of the wheel hub bearing unit should not exceed 120°C, and the grease leakage rate should not exceed 5%.

- Friction Torque: For DAC-type double-row angular contact ball bearings, the no-load friction torque should not exceed 1.1 N·m.

- Bending Fatigue Strength: The bending fatigue strength cycle count of the wheel hub bearing unit must meet specific requirements, such as a B50 of over 90,000 cycles under a large bending moment.

Furthermore, from the non-metallic inclusion test of high-carbon chromium bearing steel raw materials to the final product’s factory inspection and annual supervision sampling, every link in the entire production process is subject to strict quality control. This comprehensive quality management from source to end-user ensures that Chinese-made bearings can consistently meet or even exceed the expectations of the international market in terms of performance and reliability.

Practices in Intelligent Manufacturing and Digital Transformation

Facing growing global competition and the diversification of downstream market demands, Chinese bearing enterprises are actively embracing intelligent manufacturing and digital transformation as a “game-changer” to enhance production efficiency and competitiveness. This transformation is not merely about introducing automated equipment; more importantly, it is about achieving data-driven industrial chain collaboration and management optimization through industrial internet platforms.

The “Bearing Industry Brain” project in Xinchang County, Zhejiang, provides a highly convincing case. This industrial internet platform aggregates massive data from the entire production and operation process of the industry chain and has developed application scenarios such as industry indices, financial services, and centralized raw material procurement. Through this platform, enterprises can update and visualize production data in real-time, break down barriers between sales and production departments, and access trend data for the entire industry to guide production planning.

The effectiveness of intelligent manufacturing is significant and quantifiable. According to data from the practice in Xinchang County, after connecting to the industrial brain, the overall cost of the local bearing industry decreased by 12%, labor costs were reduced by nearly 50%, and the profit margin increased from 4% to 8% before the transformation. These figures indicate that intelligent manufacturing can not only solve the long-standing pain points of high costs and low profits in traditional manufacturing but can also fundamentally reshape a company’s production model and profitability, putting it in a more favorable position in global competition. In this process, the government has acted as a “proactive government,” providing specialized financial support and talent training to lay a solid foundation for the digital transformation of enterprises.

Breakthroughs in High-End Fields

In the transformation from “Made in China” to “Intelligent Manufacturing in China,” a series of groundbreaking achievements in key technological fields are becoming important milestones for the high-end development of China’s bearing industry:

- Wind Power Main Shaft Bearings: In March 2024, a Chinese manufacturer successfully rolled off the world’s first 25 MW wind power main shaft bearing and gearbox bearing, setting a new global record for the largest single-unit capacity for wind power bearings.10 This signifies that China now possesses the independent R&D and manufacturing capabilities for critical components of ultra-large wind turbines, achieving self-sufficiency and supply chain security for core wind power parts.10

- Tunnel Boring Machine (TBM) Main Bearings: In October 2023, a main bearing for a TBM with a diameter of 8.61 meters, independently developed by a Chinese company, rolled off the production line. It is the largest, heaviest, and highest-load-bearing integrated TBM main bearing in the world to date . Its successful development marks the full-spectrum coverage of domestically produced TBM main bearings, from small to ultra-large diameters .

- High-Speed Rail Bearings: A Chinese manufacturer has completed the design, process research, and sample manufacturing of high-speed rail bearings for speeds of 250 km/h and 350 km/h and has passed a 1.2 million km durability test bench trial, with results showing the bearings were in excellent condition . Furthermore, Chinese-made high-speed trains entered the European market for the first time in June 2024, the first project where Chinese rail technology was aligned with EU railway interoperability standards, marking a major breakthrough for high-end rail equipment “going global” .

- Aero-Engine Bearings: China has also made significant progress in the R&D of core components for aero-engines. A research team successfully developed key technologies for high-temperature, high-reliability bearings for aero-engines.11 Another company, in collaboration with experts, developed a domestic aero-engine bearing whose fatigue life was tested to be 22 times that of a certain German brand’s aero-engine bearing .

- Quantum Computing: In 2025, China’s first domestically produced commercial electron beam lithography machine, “Xizhi,” entered application testing, with precision comparable to international mainstream equipment, providing a crucial tool for the R&D of quantum chips .

These achievements collectively paint a clear picture: China’s bearing manufacturing sector is gradually breaking down long-standing technological barriers in high-end fields through continuous technological breakthroughs and innovation, laying a solid foundation for a higher position in the global industrial chain in the future.

TFL Bearings: A Prominent Representative of China’s Bearing Industry

As a prominent representative of the trend of China’s bearing manufacturing moving towards high quality and high added value, TFL Bearings fully embodies the core advantages of a new generation of Chinese manufacturers: the perfect integration of reliable performance, innovative technology, and excellent cost-effectiveness.

Core Value Proposition: Reliable Performance and Excellent Cost-Effectiveness

The core value proposition of TFL Bearings is to be a “trusted procurement partner” and a “provider of high-precision, cost-effective alternatives” for global clients. The company is committed to providing solutions with significant cost advantages without sacrificing product performance.

By effectively integrating China’s strong and complete raw material supply chain, TFL can strictly control production costs, thereby achieving a significant effect of reducing procurement costs by 50% to 80% compared to well-known international brands. This advantage does not stem from low-price competition but is based on efficient production management and supply chain integration, ensuring that the products, while being highly competitive in price, can still provide reliable performance comparable to that of mainstream manufacturers.

Technical Strength and Product Portfolio

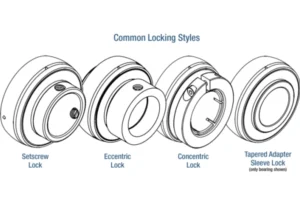

TFL Bearings has a broad and rich product line that can meet the specific needs of different industries and application scenarios. Its product portfolio includes, but is not limited to, various types such as deep groove ball bearings, cylindrical roller bearings, angular contact ball bearings, needle roller bearings, and tapered roller bearings. The product size range is wide, from miniature bearings as small as 1mm to large industrial bearings.

In terms of technical depth, TFL shows strong innovative capabilities. The company has independently developed a coating technology for insulated bearings, successfully breaking the long-standing technological monopoly held by foreign companies in this field. TFL’s insulated bearings can serve as a direct replacement for international brands like SKF and FAG, guaranteeing a minimum insulation resistance of 1000 VDC and fully complying with ISO precision standards. This core technology not only solves the high-cost problem faced by downstream customers but also echoes the aforementioned trend of structural changes in the downstream market, particularly the precise layout for new energy industries such as wind power and electric vehicles.

Quality Assurance and International Certifications

TFL Bearings’ commitment to quality is rooted in its comprehensive quality management system and has obtained multiple international authoritative certifications. The company has passed important international standards such as ISO9001, IATF 16949, RoHS, and REACH. These certifications are a direct endorsement that its production processes, product quality, and environmental management systems comply with the highest global standards.

The company’s reliability is not only reflected in its certifications but can also be proven through a series of quantifiable data:

| Indicator | TFL Bearings Data | Value Reflected |

| Number of Bearings Delivered | Over 28 million pieces | A direct reflection of market trust and large-scale production capability |

| Monthly Production Capacity | Over 100,000 units | Strong capacity assurance to meet large-scale order demand |

| Inventory Volume | Over 1 million common models in stock | Ensures fast shipment and helps customers reduce costly downtime |

| Export Scope | Over 50 countries worldwide | Broad international market coverage, serving global customers |

| Customer Repurchase Rate | 100% | The highest proof of customer satisfaction and product reliability |

These data collectively paint a picture of a highly reliable, trustworthy, and market-competitive manufacturer.

Supply Chain Capabilities and Globalization Service

TFL Bearings’ strong supply chain capability is a key factor in providing excellent value to its customers. The company maintains a large inventory of over one million pieces of commonly used bearing models, which provides a reliable procurement guarantee for customers and enables fast shipment, thereby effectively reducing the expensive costs associated with downtime.

The company’s service network also reflects its global vision. TFL’s products are exported to over 50 countries worldwide, and it has a professional team that provides customers with support from product selection and design recommendations to customized specifications and comprehensive after-sales service. This all-encompassing capability, from product to service, ensures that TFL is not just a simple supplier but a strategic partner that can provide complete solutions for its clients.

Conclusion and Outlook: Partnering with “Made in China” for a Winning Future

China’s bearing industry is at a critical turning point, moving from “large” to “strong.” Guided by national strategy, and through the deep integration of technological innovation, strict quality management, and intelligent manufacturing, Chinese manufacturers are gradually moving away from the traditional low-to-mid-range competition model and advancing toward providing high-value-added, high-performance products. Although the industry still faces challenges in certain high-end processes, through breakthroughs in specific fields like wind power, high-speed rail, and aerospace, Chinese enterprises have demonstrated their strong technological potential and market adaptability.

TFL Bearings, as a representative of this new generation of Chinese bearing manufacturers, is a microcosm of this industrial transformation. We no longer rely solely on labor cost advantages but instead, by integrating an efficient supply chain, investing in independent R&D technology, and strictly adhering to international quality standards, we provide global customers with solutions that combine reliable performance with excellent cost-effectiveness. The success of TFL Bearings in the insulated bearings field, along with its quantifiable performance in production volume, inventory, and global service network, all prove the reliability and strong competitiveness of “Made in China.”

Looking ahead, with the deepening application of intelligent manufacturing and the continuous evolution of downstream markets, China’s bearing industry will continue to undergo structural adjustments. Those manufacturers that can anticipate market trends, continue to innovate technologically, and build efficient global service networks will undoubtedly dominate future international competition. Partnering with such outstanding Chinese manufacturers will be a wise choice for global partners seeking to optimize their supply chains, reduce procurement costs, and ensure reliable performance.